child tax credit 2021 dates and amounts

See what makes us different. 15 opt out by Nov.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Last year the tax credit was also fully refundable.

. The credit amount was increased for 2021. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of.

Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Children between 6 and 17. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

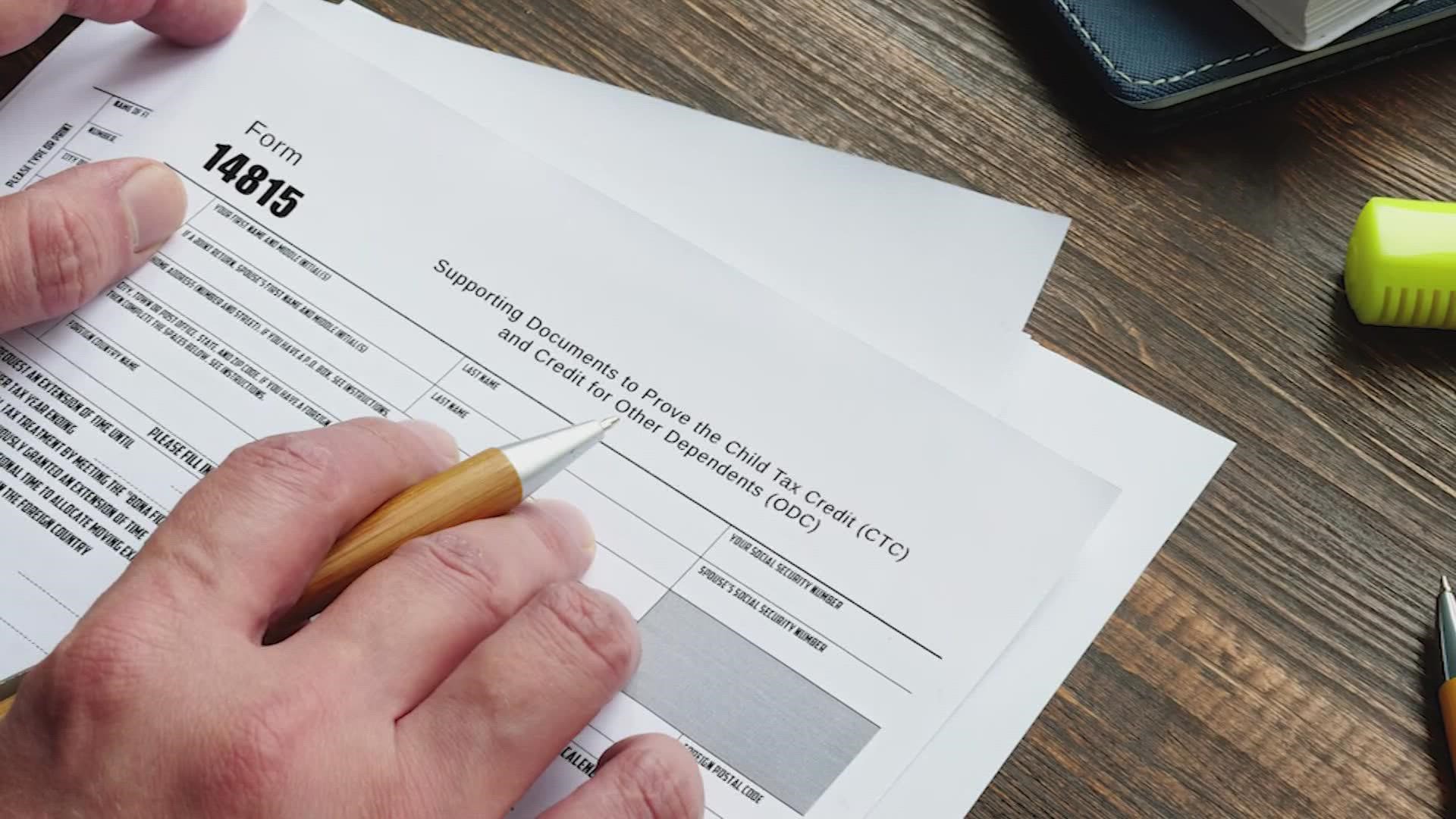

The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Florida contractors exam dates 2022. How to unenroll or opt out from advance Child Tax Credit payments this does not apply as of Dec.

We dont make judgments or prescribe specific policies. Lg k51 google pay. Number of listed companies in germany.

The payment for children. 15 opt out by Nov. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Longest girl name beginning with a. By making the Child Tax Credit fully refundable low- income households will be.

Universal credit pay dates. The credit amounts will increase for many taxpayers. 13 opt out by Aug.

15 opt out by Oct. The IRS has created a special Advance Child Tax Credit 2021 page at IRSgovchildtaxcredit2021 designed to provide the most up-to-date information about the credit and the advance payments. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

The credit was made fully refundable. 3000 for children ages 6 through 17 at the end of 2021. For July 2022 to June 2023 payment period the following maximum benefits apply.

Your amount changes based on the age of your children. The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

29 What happens with the child tax credit payments after December. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

Parents with 2021 modified AGI no greater than 40000 single filers 50000 head-of-household filers or60000 joint filers wont have to. Ad See If You Qualify To File For Free With TurboTax Free Edition. 5903 or 49191 per month.

So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under. New 2021 Child Tax Credit and advance payment details. Find COVID-19 Vaccine Locations With.

Learn more about the Advance Child Tax Credit. 3600 for children ages 5 and under at the end of 2021. For children under 6 the amount jumped to 3600.

For 2021 the maximum amount of the credit is 3600 per qualifying child. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any subsequent payments throughout 2021. Land for sale wheeler county oregon.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Child Tax Credit amounts will be different for each family. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

The government has a child and family benefits calculator you can use to estimate your monthly CCB payments. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. 15 opt out by Aug.

When you file your 2021 tax return you can claim the other half of the total CTC. 6997 or 58308 per month. The 500 nonrefundable Credit for Other Dependents amount has not changed.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. By August 2 for the August. We provide guidance at critical junctures in your personal and professional life.

Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. 112500 for a family with a single parent also called Head of Household. 150000 for a person who is married and filing a joint return.

The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Did Your Advance Child Tax Credit Payment End Or Change Tas

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit Dates As Irs Set To Send Out New Payments

The Child Tax Credit Toolkit The White House

Why Is There No Child Tax Credit Check This Month Wusa9 Com

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

The Child Tax Credit Toolkit The White House

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Childctc The Child Tax Credit The White House